Chance News 107: Difference between revisions

m (→Quotations) |

|||

| Line 9: | Line 9: | ||

<div align=right>Nassam Nicholas Taleb, cited in [http://www.amazon.com/The-Quants-Whizzes-Conquered-Destroyed/dp/0307453383 <i>The Quants</i>], by Scott Patterson, 2010</div> | <div align=right>Nassam Nicholas Taleb, cited in [http://www.amazon.com/The-Quants-Whizzes-Conquered-Destroyed/dp/0307453383 <i>The Quants</i>], by Scott Patterson, 2010</div> | ||

Submitted by Margaret Cibes | Submitted by Margaret Cibes | ||

---- | |||

“[E]conomic decisions are usually best made on the basis of ‘expected value’ …. Clearly just one of the many things that can happen will happen – not the average of all of them. …. I always say I have no interest in being a skydiver who’s successful 95% of the time.”<br> | “[E]conomic decisions are usually best made on the basis of ‘expected value’ …. Clearly just one of the many things that can happen will happen – not the average of all of them. …. I always say I have no interest in being a skydiver who’s successful 95% of the time.”<br> | ||

Revision as of 18:56, 23 September 2015

Quotations

"Mr. Slemrod [a public finance economist at the University of Michigan] also urged economists to talk in terms of ranges rather than point estimates when discussing how taxes affect the economy, to reflect the fact that these figures are simply educated guesses. But he understands why they don’t. 'Washington wants a number,' he said. “Washington doesn’t like confidence intervals.'"

Submitted by Bill Peterson

“If ten thousand people flip a coin, after ten flips the odds are there will be someone who has turned up heads every time. People will hail this man as a genius, with a natural ability to flip heads. Some idiots will actually give him money. This is exactly what happened to LTCM. But it’s obvious that LTCM didn’t know [bleep] about risk control. They were all charlatans.”

Submitted by Margaret Cibes

“[E]conomic decisions are usually best made on the basis of ‘expected value’ …. Clearly just one of the many things that can happen will happen – not the average of all of them. …. I always say I have no interest in being a skydiver who’s successful 95% of the time.”

“Loss occurs when risk – the possibility of loss – collides with negative events. Thus the riskiness of an investment becomes apparent only when it is tested in a negative environment. …. The fact that an investment is susceptible to a serious negative development that will occur only infrequently … can make it appear safer than it really is. …. That’s why Warren Buffett famously said, ‘… you only find out who’s swimming naked when the tide goes out.’”

Submitted by Margaret Cibes

Forsooth

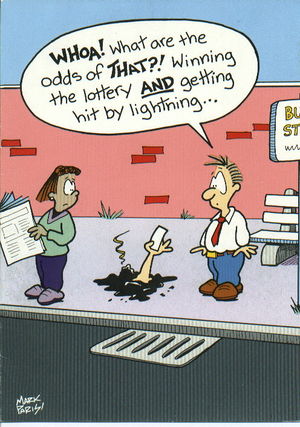

The last edition of Chance News included a story on Lightning and the lottery, which is reminiscent of the following greeting card:

Submitted by Alan Shuchat

"... I’ve listed the share of Democratic voters who identified as liberal, and as white, in the 39 states where the networks conducted exit polls during the 2008 Democratic primaries. Then I’ve multiplied the two numbers together to estimate the share of Democrats in each state who were both white and liberal. ...It would be better if the exit polls directly listed the number of white liberals. Unfortunately, the exit polls do not provide this data, so we have to live with an estimate instead."

Submitted by Peter Doyle